You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Deciding on short-term or long-term investments is crucial for your financial success. Investors often act out of impulse, swayed by market trends, anxiety, or inappropriate advice. This can lead to anxiety, fluctuating returns, and uncertainty during market shifts.

This comprehensive guide demystifies the key distinctions between short-term and long-term investments, covering operational methods, associated risks, and how to tailor your strategy to reflect personal objectives, financial stability, age, and market dynamics. The aim is to facilitate a clear, informed, and confident choice.

Investment timeframe is about the duration you intend to maintain your investment prior to accessing it.

Short-term investments generally span from several months to 3 years.

Long-term investments often last 5 years, 10 years, or longer.

Your chosen duration significantly influences risk, potential returns, emotional security, and financial results.

Most confusion arises from mismatching goals and timelines.

Common pitfalls include:

Utilizing long-term investments for immediate needs.

Anticipating fast returns from slow-growth assets.

Reacting excessively to market declines due to short timeframes.

Freezing short-term cash in illiquid options.

Clarity about objectives is paramount over mere product selection.

Short-term investments emphasize capital security, liquidity, and consistency instead of rapid growth.

Reduced risk versus equity-heavy investments.

Forecastable or moderately steady returns.

High liquidity for easy access.

Lower market volatility exposure.

These are aimed at protecting capital rather than aggressive expansion.

Fixed deposits

Treasury bills

Liquid mutual funds

Short-duration debt funds

High-interest savings accounts.

Such options shine brightest when certainty trumps growth.

Short-term investments suit those who can't afford any loss.

Funds are readily available during emergencies or planned expenditures.

Minimal market shifts ease stress and decision-making.

Returns are simpler to forecast, aiding short-term financial planning.

Despite their safety, short-term investments have limitations.

Returns may lag behind inflation, eroding actual purchasing power.

They are not crafted for significant wealth accumulation.

Interest income is often fully taxable, diminishing net returns.

While short-term investments protect funds, they seldom provide meaningful growth.

Long-term investments center on wealth enhancement through compounding over time.

Greater exposure to market fluctuations.

Enhanced return potential.

Patience and discipline are essential.

Capitalize on compounding.

They benefit most when given adequate time to absorb market variations.

Equity mutual funds

Direct stock investments

Index funds

Real estate

Retirement-focused plans.

These thrive on longevity, consistency, and remaining invested.

Returns generate further returns, accelerating overall growth.

Long-term investments often outpace inflation.

They are crucial for achieving substantial financial objectives.

Many long-term investments receive favorable tax treatment.

While powerful, long-term investing is not without its risks.

Short-term losses can arise, especially during economic downturns.

Fear during market dips can prompt premature exits.

Funds are tied up for longer durations, limiting flexibility.

The biggest risk is exiting too early, rather than market fluctuations.

Your time horizon is critical for your investment choice.

Best for short-term investments, given limited recovery window.

Requires a balanced approach, ensuring both safety and growth.

Optimal for long-term investments, permitting markets to buffer volatility.

Utilizing time effectively can mitigate risk.

Invest based on specific goals, not general advice.

Emergency savings

Travel expenses

Car acquisition

Business capital needs.

These call for stability and ease of access.

Retirement planning

Education for children

Wealth building

Financial independence.

These necessitate growth-oriented investment strategies.

Aligning goals with timelines helps prevent stress and losses.

Risk tolerance is more about emotional comfort than bravery.

If market variances are unsettling, short-term investments may feel safer.

If you can remain calm during market volatility, long-term investments can serve as powerful tools.

Risk tolerance can shift with age, income stability, and responsibilities.

Stable income allows for higher risk-taking.

A consistent salary supports long-term investments.

Ineffective income streams require greater liquidity.

Business owners often need flexible investments.

Your income arrangement should dictate investment duration.

Attempting to time the market is often ineffective.

Markets are in constant flux, while your personal objectives are fixed.

Funds earmarked for the short-term should disregard market noise.

Funds allocated for the long-term should overlook instantaneous headlines.

Discipline trumps prediction.

Betting on one type doesn't have to be the only strategy.

Emergency and immediate goals in short-term funds.

Umbrage wealth creation through long-term investments.

This lessens anxiety while promoting growth.

Market slumps may lead to losses.

This erodes future purchasing power.

Emotional decisions frequently undermine returns.

Mainstream investments may not reflect your timeline.

Long-term investments should be prioritized for their extended duration.

Balanced allocations become pivotal as responsibilities grow.

Capital preservation and consistent income are essential.

Investment timelines evolve through life’s stages.

Liquidity dictates the quickness of access to cash.

Short-term investments offer heightened liquidity while long-term investments often trade liquidity for enhancement.

Overlooking liquidity needs can cause financial strain.

Confidence derives from understanding.

Define your objectives.

Set your timelines.

Grasp your risk tolerance.

Differentiate between short- and long-term funds.

A clear structure minimizes fear during uncertain times.

Short-term investments offer security and reliability, while long-term investments provide growth and financial liberation. Neither option is inherently superior; the best choice hinges on objectives, patience, and strategic planning.

When investments resonate with set timelines, your money can operate efficiently behind the scenes, sans constant anxiety.

This article is intended purely for informational purposes and should not serve as financial, investment, or legal guidance. Investment results will vary based on individual financial situations, goals, risk tolerance, and market changes. Readers should consult certified financial advisors before making any investment decisions or changes to their financial plans.

Thailand Defence Minister Joins Talks to End Deadly Border Clash

Thailand’s defence chief will join talks with Cambodia as border clashes stretch into a third week,

India Raises Alarm Over Fresh Attacks on Hindus in Bangladesh

India has condemned recent killings of Hindu men in Bangladesh, calling repeated attacks on minoriti

Sidharth Malhotra & Kiara Advani Celebrate Baby Saraayah’s 1st Christmas

Sidharth and Kiara share adorable moments of baby Saraayah’s first Christmas with festive décor and

South Korea Seeks 10-Year Jail Term for Former President Yoon Suk Yeol

South Korea’s special prosecutor demands 10 years for ex-President Yoon Suk Yeol on charges includin

Salman Khan’s Exclusive 60th Birthday Bash at Panvel Farmhouse

Salman Khan to celebrate his 60th birthday privately at Panvel farmhouse with family, friends, and a

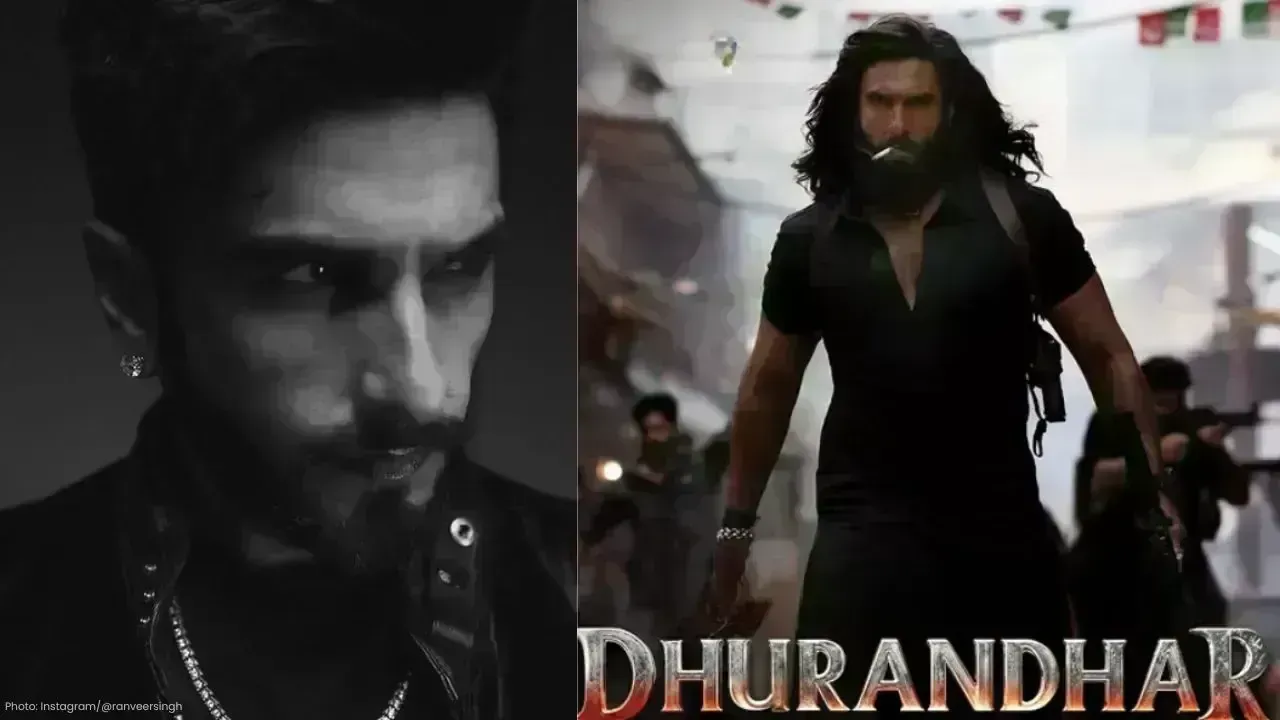

Dhurandhar Breaks Records with Rs 1006 Cr, Becomes Bollywood’s Biggest Hit

Dhurandhar rakes in over Rs 1006 crore worldwide in 21 days, becoming Bollywood’s highest-grossing f