You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

As the global economic landscape evolves, investors, policymakers, and businesses are keeping a close eye on emerging markets poised for significant growth in 2025. These economies are attracting attention not just for their robust GDP projections, but also for strategic reforms, infrastructure development, and increasing foreign direct investment (FDI). Understanding these markets can help investors identify high-potential opportunities and navigate the challenges of a rapidly shifting global economy.

This article explores the top emerging markets to watch in 2025, highlighting what is driving their growth, key sectors, and the opportunities they present for investors and businesses alike.

Emerging markets are countries experiencing rapid growth and industrialization but are not yet classified as developed. They are often characterized by:

Rapidly increasing GDP

Expanding consumer markets

Political and economic reforms

High growth potential in key sectors such as energy, technology, and manufacturing

These markets are critical for global growth. They contribute significantly to global trade, attract foreign investments, and offer opportunities for diversification, especially when mature markets face stagnation.

The following countries are forecasted to lead in growth, innovation, and investment potential in 2025.

Projected GDP Growth: 16.3%

Why It’s Growing: Guyana’s economy is being transformed by its rapidly expanding oil industry. Production has surged from virtually zero in 2019 to over 600,000 barrels per day by late 2024, with expectations to reach nearly 900,000 barrels in 2025.

Investment Opportunities: Oil and gas infrastructure, logistics, and energy-related services.

Guyana’s government is leveraging oil revenues to fund public investments in infrastructure, health, and education, providing a solid foundation for sustainable economic growth.

Projected GDP Growth: 16.2%

Growth Drivers: After years of conflict, South Sudan is stabilizing its oil production and expanding exports.

Opportunities: Energy, infrastructure, agriculture, and public-private partnerships.

The country’s recovery highlights the potential of resource-driven emerging economies, especially when political stability and governance improve.

Projected GDP Growth: 14.4%

Why It’s Growing: Libya benefits from a resurgence in oil production following political stabilization. The government is actively seeking foreign investment to rebuild critical infrastructure.

Investment Opportunities: Energy, construction, and logistics sectors.

Libya exemplifies how reforms and investment-friendly policies can drive rapid economic rebound in post-conflict economies.

Projected GDP Growth: 9.4%

Growth Drivers: Investments in infrastructure, energy, and mining sectors are fueling growth.

Opportunities: Manufacturing, mining, renewable energy, and digital services.

Senegal’s government is focused on economic diversification and regional integration, enhancing its attractiveness for both regional and global investors.

Projected GDP Growth: 8.9%

Why It’s Growing: Palau’s economy is rebounding due to tourism recovery and sustainable investment initiatives.

Opportunities: Eco-tourism, renewable energy, and conservation-focused projects.

Palau is a prime example of an eco-conscious emerging market, where sustainability meets economic growth.

Projected GDP Growth: 8.4%

Key Drivers: Development of uranium mining and agricultural expansion.

Opportunities: Mining, agribusiness, renewable energy, and infrastructure projects.

Niger’s growth highlights the importance of resource-based economies in driving development in emerging markets.

Projected GDP Growth: 8.2%

Why It’s Growing: Rwanda has implemented reforms fostering technology adoption, services, and manufacturing.

Opportunities: ICT, fintech, logistics, and healthcare innovation.

Rwanda’s emphasis on innovation, governance, and investment incentives makes it a model for African economic growth.

Projected GDP Growth: 6.2%

Growth Drivers: India benefits from a large domestic market, digital transformation, and strong manufacturing initiatives.

Opportunities: E-commerce, fintech, renewable energy, IT services, and manufacturing.

India’s infrastructure projects and business-friendly reforms continue to attract FDI, making it a cornerstone of emerging market growth.

Projected GDP Growth: 6.0%

Why It’s Growing: Vietnam is positioning itself as a regional manufacturing hub, leveraging trade agreements and a competitive labor force.

Opportunities: Electronics manufacturing, textiles, logistics, and technology services.

Vietnam exemplifies the export-oriented growth model and strategic policy alignment with global trade trends.

Projected GDP Growth: 5.7%

Key Drivers: Strong domestic consumption, infrastructure projects, and digital economy growth.

Opportunities: E-commerce, fintech, renewable energy, and urban development.

Indonesia’s diverse economy offers opportunities across multiple sectors, balancing traditional industries with high-tech innovation.

While each country has unique drivers, several common sectors are powering growth:

Energy & Natural Resources – Oil, gas, and mining remain foundational for resource-rich economies like Guyana, Libya, and Niger.

Technology & Digital Services – India, Vietnam, and Rwanda are leveraging digital adoption to fuel innovation and productivity.

Tourism & Hospitality – Countries like Palau and Senegal are capitalizing on tourism recovery and eco-tourism trends.

Infrastructure & Urban Development – Roads, ports, and industrial zones remain critical for sustainable growth.

Manufacturing & Exports – Export-oriented policies, trade agreements, and competitive labor pools are driving Vietnam, India, and Indonesia.

Emerging markets are often more volatile than developed markets, but they also offer higher potential returns. Key reasons to watch them in 2025 include:

High GDP Growth Potential: Many emerging economies are projected to grow at double-digit rates, outpacing developed nations.

Demographic Advantages: Large, young populations in countries like India and Vietnam create dynamic consumer markets.

Policy Reforms: Business-friendly policies and economic liberalization attract foreign direct investment.

Infrastructure Expansion: New ports, transport systems, and urban development projects provide investment opportunities.

Digital Transformation: Technology adoption boosts efficiency, innovation, and international competitiveness.

While the growth potential is high, investors should also account for:

Political Stability: Governments must maintain stability to attract sustained investment.

Regulatory Risks: Emerging markets may have evolving legal frameworks that require careful navigation.

Currency Volatility: Exchange rate fluctuations can impact returns.

Infrastructure Gaps: Despite improvements, infrastructure may lag in remote areas.

Global Market Sensitivity: Emerging economies are often more affected by global trade, commodity prices, and financial conditions.

Diversify Across Regions: Spread investments across multiple countries to mitigate risk.

Focus on Growth Sectors: Energy, digital, manufacturing, and infrastructure often offer higher returns.

Monitor Policy and Regulatory Changes: Stay updated on reforms and incentives.

Engage Local Expertise: Partner with local businesses, consultants, or investment advisors.

Long-Term Perspective: Emerging market growth often requires patience and strategic planning.

As 2025 approaches, emerging markets present some of the most compelling investment opportunities in the global economy. From oil-rich Guyana to tech-driven Rwanda and manufacturing hubs like Vietnam, these economies are positioned to deliver significant growth.

However, while the prospects are exciting, investors must balance opportunities with risk. Political stability, regulatory clarity, and infrastructure readiness are key factors to evaluate. With careful research and strategic planning, emerging markets can offer high returns and long-term value in a world where developed markets are increasingly saturated.

For investors, businesses, and policymakers, keeping an eye on these high-growth economies will be critical in shaping strategies and seizing opportunities in 2025 and beyond.

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as

Bangladesh Cricket to Work with ICC on T20 World Cup Security

Bangladesh Cricket Board will cooperate with ICC to resolve security concerns and ensure team partic

Flash Floods in Indonesia’s North Sulawesi Kill 16, Hundreds Displaced

Deadly flash floods triggered by heavy monsoon rains in North Sulawesi, Indonesia, killed 16 people,

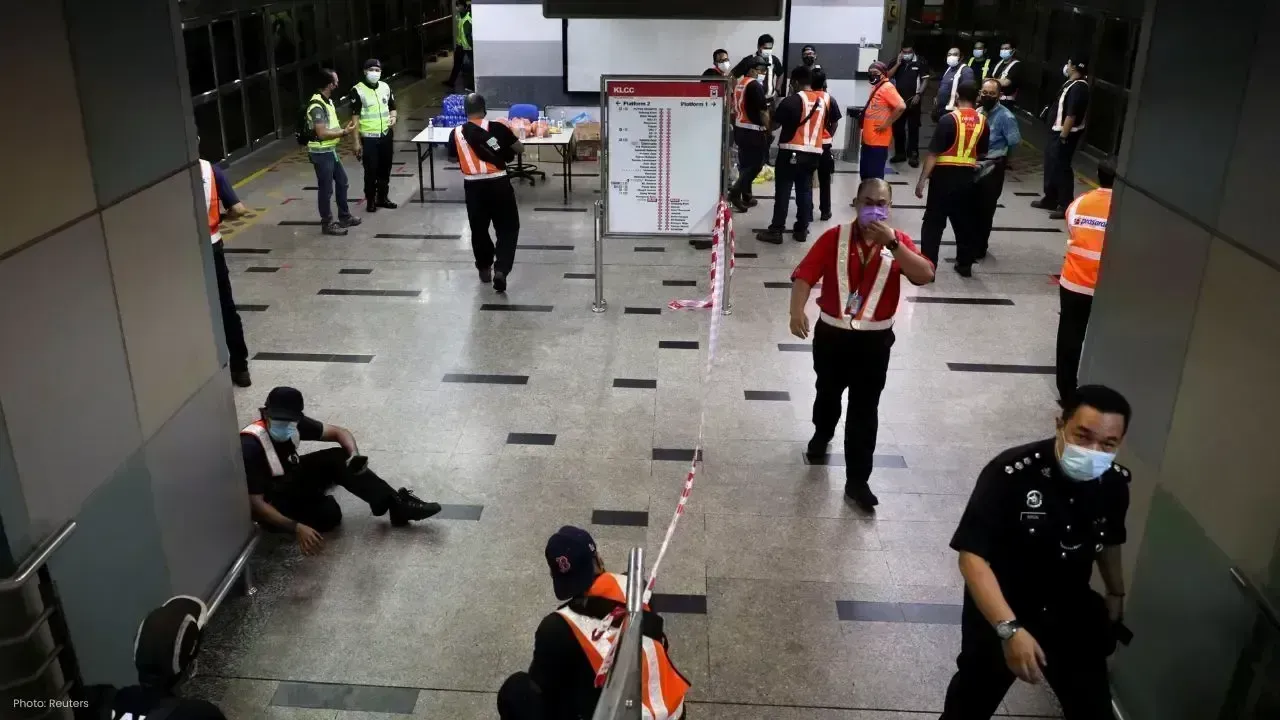

Prasarana Rail Reliability Soars as Service Breakdowns Fall in 2025

Prasarana records a major drop in rail service disruptions in 2025, while rising ridership signals r

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from