You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Your credit score plays a crucial role in your financial health, influencing your ability to secure loans, credit limits, and even rental agreements. A drop in your score can classify you as a high-risk borrower. Fortunately, improving your score is achievable if you adopt the correct methods. This guide outlines five proven strategies that can help you enhance your score quickly and effectively, steering clear of risky shortcuts.

Identifying the reasons behind a falling score is vital for rectifying the situation. Common culprits include late payments, unpaid debts, high credit card usage, multiple loan inquiries, inaccuracies in your credit report, closing old accounts, and inconsistent payment patterns. Oftentimes, one missed payment can adversely affect your score for an extended period. Prioritize addressing the most damaging factors.

Unpaid credit cards, missed EMIs, or even forgotten bills can substantially impact your credit score. Tackling these small debts first leads to swift visible improvements since they are typically easier to settle and quickly reflected in your credit report.

Check your statements for overdue payments, settle all overdue minimum balances immediately, and ensure you never miss a due date. Even small amounts can negatively impact your score by signaling poor repayment behavior.

Your score can begin to improve within one to two billing cycles after clearing these debts, making this one of the fastest methods for boosting your score.

Credit utilization refers to the percentage of available credit being used. For example, if your limit is 100,000 and you regularly use 70,000, your ratio is 70%, which is considered excessively high. High utilization suggests financial strain and can lower your credit score.

Keep your utilization below 30 percent of your credit limit.

For optimum results, aim for a figure between 10 to 20 percent over a couple of months.

Pay off your credit card debts during the billing cycle rather than at the due date. Request a limit increase from your bank. Distribute expenses across multiple cards to ensure no single card exceeds a 30 percent usage rate. This can yield quick improvements as it updates every billing cycle.

Late payments are one of the most detrimental factors for your credit score. Just one missed EMI can linger in your report for years. Setting up automatic payments ensures you never miss a due date.

Activate auto-debit for all credit cards and bills. Maintain a buffer balance to ensure successful payments. Enable SMS alerts and reminders to avoid low balances.

Consistent repayment habits are key to credit scoring. Demonstrating reliable payment behavior for two to three months can gradually rebuild your score.

Errors or outdated information may be responsible for your low score. Many individuals neglect to check their credit reports regularly and miss opportunities to rectify damaging inaccuracies.

Incorrect balances, duplicate loans, erroneous personal details, closed accounts marked as active, or fraudulent accounts opened unknowingly.

Obtain your credit report from official sources, identify any discrepancies, and file disputes immediately. Most bureaus will take 30 days to validate and correct errors, and correcting significant inaccuracies can lead to a noticeable score improvement.

Opening a new credit line can enhance your score by diversifying your credit mix and demonstrating responsible usage. Secured credit options are particularly beneficial if your score is already compromised.

Consider secured credit cards linked to savings accounts, low-EMI personal loans, or responsibly used buy-now-pay-later accounts.

New positive credit behavior contributes to score recovery, signaling to lenders that you are a reliable borrower. Utilizing this credit line responsibly for approximately three months can elevate your score more effectively than merely closing negative accounts.

Avoid applying for several loans at once. Retaining older credit accounts is beneficial since credit age positively impacts scores. When using credit cards, pay more than the minimum. Keep credit lines active with small purchases. Refrain from settling loans unless necessary, as this can lead to a significant drop in your score.

While some improvements may be visible within a month, substantial increases typically take two to six months, depending on the severity of your credit issues. Consistency is crucial; your score will improve as negative behaviors are halted and positive habits are adopted.

Rapidly enhancing your credit score requires a multi-faceted approach: clearing overdue balances, lowering utilization, maintaining a stellar payment record, rectifying report inaccuracies, and establishing positive credit history. Each of these measures fortifies your financial standing, enabling access to better interest rates and higher credit limits. With discipline and informed strategies, anyone can create a robust credit profile, even after facing challenges.

This article serves as general financial guidance intended to aid readers in enhancing their credit scores. It does not replace professional financial, legal, or credit repair advice. Credit scores vary based on unique financial histories, lender rules, and credit bureau updates. Readers are encouraged to evaluate their individual situations or consult a certified financial advisor before making decisions.

Thailand Defence Minister Joins Talks to End Deadly Border Clash

Thailand’s defence chief will join talks with Cambodia as border clashes stretch into a third week,

India Raises Alarm Over Fresh Attacks on Hindus in Bangladesh

India has condemned recent killings of Hindu men in Bangladesh, calling repeated attacks on minoriti

Sidharth Malhotra & Kiara Advani Celebrate Baby Saraayah’s 1st Christmas

Sidharth and Kiara share adorable moments of baby Saraayah’s first Christmas with festive décor and

South Korea Seeks 10-Year Jail Term for Former President Yoon Suk Yeol

South Korea’s special prosecutor demands 10 years for ex-President Yoon Suk Yeol on charges includin

Salman Khan’s Exclusive 60th Birthday Bash at Panvel Farmhouse

Salman Khan to celebrate his 60th birthday privately at Panvel farmhouse with family, friends, and a

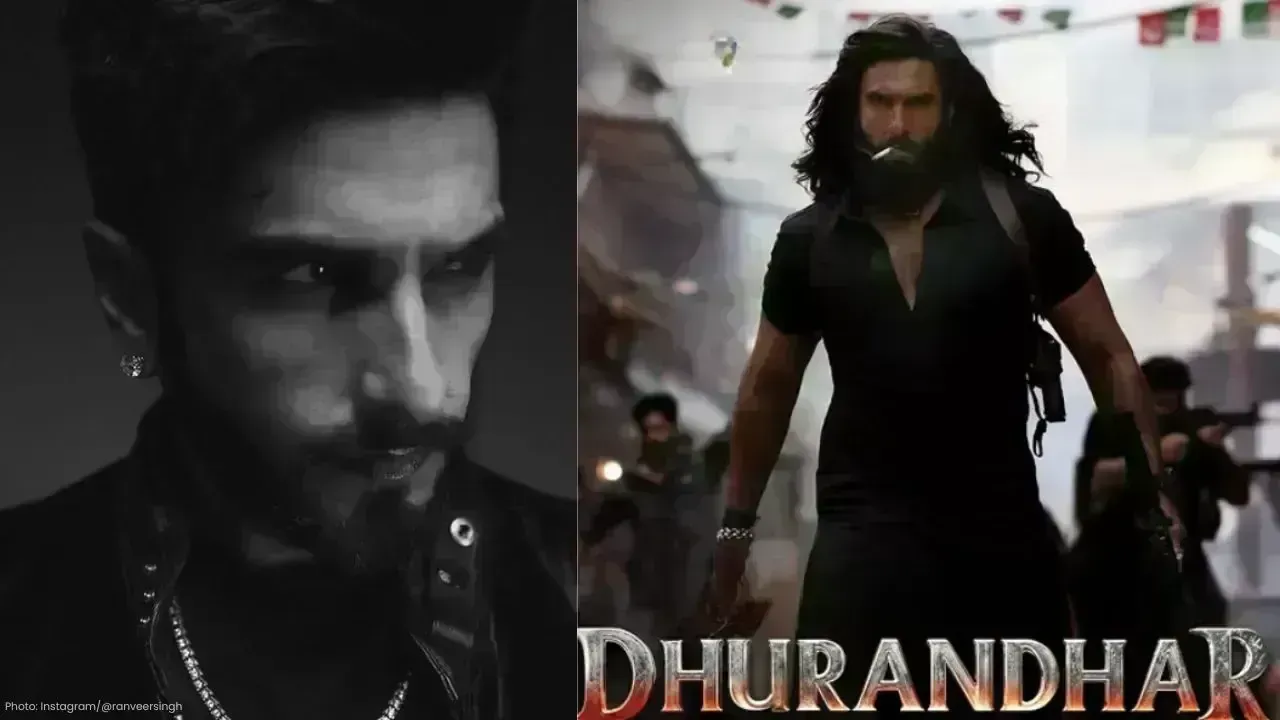

Dhurandhar Breaks Records with Rs 1006 Cr, Becomes Bollywood’s Biggest Hit

Dhurandhar rakes in over Rs 1006 crore worldwide in 21 days, becoming Bollywood’s highest-grossing f