You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

The Indian stock market witnessed a subdued session as benchmark indices struggled to find direction amid mixed global cues and cautious investor sentiment. Early optimism faded quickly as selling pressure intensified in frontline stocks, dragging both the Sensex and Nifty lower.

Market participants remained wary amid concerns over global interest rate trajectories, fluctuating crude oil prices, and ongoing geopolitical uncertainties. Domestic cues, including profit booking after recent highs and selective weakness in heavyweight stocks, further dampened sentiment.

The Sensex slipped over 100 points during early trade, reflecting broad-based weakness across sectors. Meanwhile, the Nifty 50 breached the psychological 26,250 level, signaling a pause in the recent rally.

Sensex: Trading lower with modest losses

Nifty 50: Slips below 26,250

Bank Nifty: Underperforms amid banking sector pressure

Midcap and Smallcap Indices: Largely range-bound with selective buying

Despite the decline in headline indices, market breadth remained mixed, suggesting that investors are rotating selectively rather than exiting equities entirely.

The downturn in the indices was largely driven by sharp selling in heavyweight stocks, particularly in the banking and energy sectors.

Shares of HDFC Bank declined around 2 percent, emerging as one of the top drags on the indices. Investors appeared cautious ahead of upcoming macroeconomic data and lingering concerns over margin pressures in the banking sector.

Other banking stocks also witnessed mild to moderate losses, reflecting a broader risk-off mood in financials.

Energy major Reliance Industries also slipped nearly 2 percent, adding significant pressure on the benchmark indices due to its heavy weightage. Weakness in global energy markets and profit booking at higher levels contributed to the decline.

Sectoral indices largely traded in the red, with only a few pockets of resilience visible.

The banking index underperformed the broader market, dragged by losses in large private lenders. Rising bond yields and cautious commentary from global central banks kept investors on edge.

Energy stocks faced selling pressure amid volatile crude oil prices and concerns over demand outlook. Refining margins and global supply dynamics remained key variables influencing investor sentiment.

Information technology stocks displayed relative resilience, supported by a stable outlook for global tech spending and a mildly weaker rupee. However, gains remained capped as investors awaited fresh triggers.

Metal stocks traded mixed amid uncertainty around global growth prospects. FMCG stocks also saw selective selling, as valuations remain stretched in certain counters.

Global markets offered limited support to domestic equities. Asian markets traded mixed as investors assessed fresh economic data from major economies.

Expectations around interest rate cuts by major central banks

Volatility in crude oil prices

Concerns over slowing global growth

Ongoing geopolitical developments

US markets closed on a mixed note overnight, with technology stocks providing some support while broader indices faced pressure.

After a strong rally in recent weeks, investors appeared inclined to book profits, particularly in large-cap stocks that had seen sharp gains. Analysts believe the current dip is more of a healthy consolidation rather than the start of a prolonged downturn.

Valuations in select segments remain elevated

Lack of immediate positive triggers

Upcoming macroeconomic data releases

Uncertainty around global monetary policy

Market participants are closely watching inflation trends and central bank commentary for cues on the future direction of interest rates.

From a technical perspective, the Nifty slipping below 26,250 is being closely monitored by traders.

Immediate Support: Around 26,100

Next Support: Near 25,950

Immediate Resistance: 26,350

Strong Resistance: 26,500

A sustained move below key support levels could trigger further selling, while a bounce from current levels may attract fresh buying interest.

While benchmark indices remained under pressure, midcap and smallcap stocks showed mixed trends. Select stocks in manufacturing, defense, and renewable energy attracted buying interest, reflecting long-term optimism in these themes.

However, experts advise caution, as volatility in broader markets tends to be higher during periods of consolidation in large caps.

Institutional flows played a crucial role in shaping market direction.

Foreign investors remained cautious, with intermittent selling observed in large-cap stocks. Global risk sentiment and currency movements continue to influence FII behavior.

Domestic funds provided some support to the market, cushioning the downside. Systematic investment flows from retail investors continue to lend stability to Indian equities.

Market experts believe that near-term volatility may persist as investors digest global and domestic developments. However, the broader outlook for Indian equities remains constructive, supported by strong economic fundamentals and robust corporate earnings growth.

Global inflation and interest rate cues

Corporate earnings updates

Movement in crude oil prices

Currency fluctuations

Geopolitical developments

Investors are advised to adopt a stock-specific approach and focus on fundamentally strong companies with long-term growth potential.

In the current environment, experts suggest a balanced strategy.

Avoid panic selling during short-term corrections

Use dips to accumulate quality stocks gradually

Maintain diversification across sectors

Keep a close eye on global cues and macro data

Long-term investors may view such corrections as opportunities, while short-term traders should remain cautious and adhere to strict risk management practices.

The decline in the Sensex and Nifty reflects a temporary pause in the market’s upward journey rather than a fundamental shift in trend. Selling in heavyweight stocks like HDFC Bank and Reliance Industries weighed heavily on the indices, but broader market participation remains intact.

As long as key support levels hold, the overall structure of the market remains healthy. Investors would do well to stay patient, informed, and disciplined amid ongoing volatility.

This article is for informational purposes only and does not constitute investment advice. Stock market investments are subject to market risks. Readers are advised to consult with a qualified financial advisor before making any investment decisions.

Heavy Clashes in Aleppo Between Syrian Forces and Kurdish Fighters

Fighting erupted in Aleppo for a second day, displacing thousands and leaving at least four dead as

Bangladesh Cricket to Work with ICC on T20 World Cup Security

Bangladesh Cricket Board will cooperate with ICC to resolve security concerns and ensure team partic

Flash Floods in Indonesia’s North Sulawesi Kill 16, Hundreds Displaced

Deadly flash floods triggered by heavy monsoon rains in North Sulawesi, Indonesia, killed 16 people,

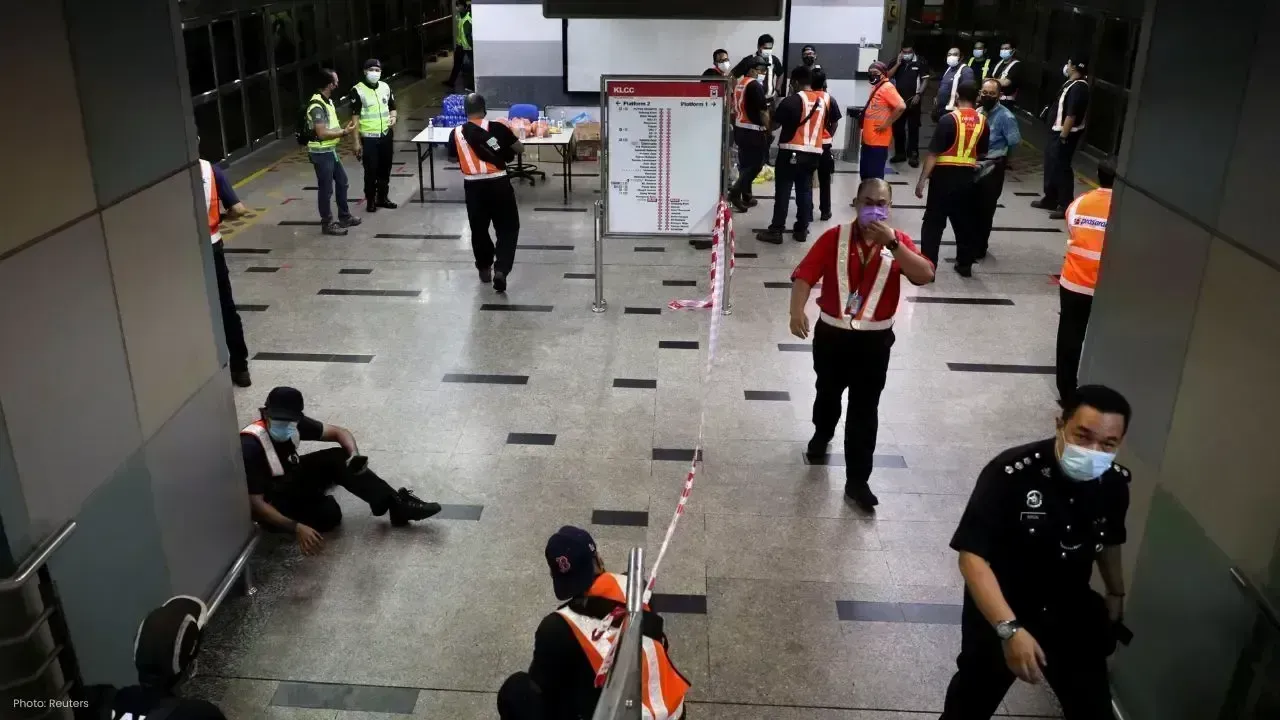

Prasarana Rail Reliability Soars as Service Breakdowns Fall in 2025

Prasarana records a major drop in rail service disruptions in 2025, while rising ridership signals r

Denmark Cautions NATO's Stability Threatened by US Moves on Greenland

Denmark's Prime Minister warns NATO could collapse if the US attempts military action in Greenland a

Agastya Nanda’s Ikkis Sees Box Office Decline on Monday

Ikkis earned Rs 1.13 crore on its first Monday despite strong opening, facing tough competition from