You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Financial stability is frequently perceived as a product of high salaries or significant investments, but in truth, it is cultivated through small daily choices that might appear trivial now but accumulate significance over time. The decisions you make about spending, saving, ignoring, or automating daily expenditures have more influence on your long-term financial trajectory than sporadic, substantial actions.

This article delves into how daily choices can subtly shape your financial landscape, why many people face challenges despite good incomes, and how simple awareness can gradually turn financial stress into stability.

Many assess their financial situation only during major milestones—such as tax season, salary increases, emergencies, or significant expenditures. Yet, successful money management is a daily practice, not a yearly inspection.

Seemingly harmless intentions like opting for convenience over planning, overlooking minor expenses, or postponing savings accumulate over time, affecting crucial factors:

Steady cash flow

Debt accumulation

Emergency preparedness

Wealth over time

True financial stability is not about perfection but rather the consistent choice of small, wise actions.

Human psychology often favors immediate gratification over long-term security.

They seem too trivial to impact

Effects manifest later

They lack immediate repercussions

Hence, daily overspending often occurs, while panic arises in financial emergencies. The real threat lies in countless unnoticed small decisions.

Daily spending behaviors dictate whether your financial situation feels manageable or spiraled out of control.

Small expenditures—like food delivery, impulse buys, subscriptions, or unnecessary upgrades—rarely feel costly on their own. Yet, over time, they can:

Limit savings potential

Heighten reliance on credit

Constrict your monthly flexibility

Convenience spending often leads to future financial burdens.

Deliberately managing spending enhances awareness and control. Those who attain financial stability may not spend less; they simply spend mindfully.

Saving isn’t merely about large amounts deposited; it revolves around consistent actions.

Many delay saving, thinking the amounts are insignificant. However:

Small amounts reinforce good habits

Consistency mitigates mental hurdles

Starting early compounds benefits over time

By skipping saving, one inadvertently conveys that saving is optional.

Improved financial stability emerges when saving is treated as a necessary and regular habit, not an afterthought.

Your payment choices directly shape your financial mindset.

Using credit cards often leads to:

Diminished spending awareness

Impulsive buying tendencies

Postponed financial consequences

This sometimes subtly undermines financial discipline.

Establishing clear limits, ensuring timely payments, and controlled card use fosters trust in one's financial management capabilities.

Decisions regarding lifestyle often escalate financial pressures.

As earnings rise, expenditures often creep upward:

Upgraded housing

Increased dining out

Premium subscription services

Overwhelming subscription loads

Without awareness, an uptick in income may simply escalate the same stresses.

Financially stable individuals prioritize:

Flexibility over aesthetics

Savings over social status

Peace of mind over fleeting thrills

Debt accumulates from ongoing tolerance rather than sudden shifts.

Making just the minimum payments

Relying on credit for discretionary purchases

Delaying repayments under the guise of “just this once”

Each postponement raises interest, stress, and dependency.

Maintaining a close watch on outstanding debt

Prioritizing repayment of high-interest debts

Avoiding emotional borrowing

Debt discipline is established through daily actions, not when the burden becomes unbearable.

Utilizing automation lessens reliance on willpower.

Humans can be forgetful and procrastinate, which can lead to missed bills or savings opportunities.

Setting up automatic savings transfers

Scheduling regular bill pay dates

Investment automatic deductions

Automation helps transform intentions into reliable outcomes.

Your time management directly impacts your financial steadiness.

Excessive social media browsing

Lax boundaries at work

Delayed skills acquisition

Such choices limit potential income growth.

Invest time in personal growth

Protect concentrated work periods

Minimize unproductive behaviors

Daily discipline significantly influences income growth.

Emotions can strongly dictate financial actions.

Purchasing for stress relief

Overspending during celebrations

Securitizing against fear

These actions gradually erode financial stability.

Stable finances arise from:

Taking a moment before purchases

Separating emotions from spending decisions

Establishing spending guidelines

Better emotional regulation leads to improved financial control.

Your health and finances are intrinsically connected.

Medical costs

Decreased productivity

Lower earning potential

Neglecting health now can lead to financial pressures in the future.

Simple daily habits—like staying active, getting enough sleep, and eating well—can significantly minimize future financial shocks.

Financial stress rarely appears overnight.

Falling savings rates

Increases in credit usage

Shrinking monthly surplus

Anxiety associated with discussing finances

Ignoring these indicators allows minor problems to blossom into larger crises.

Awareness is often an undervalued financial skill.

Quicker adjustments to spending

Lower financial anxiety

Enhanced confidence in decision-making

Improved long-term outcomes

Stability arises when financial choices become intentional rather than reactive.

Financial stability is not about flashy displays of wealth.

Fewer impulsive purchases

Gradual lifestyle upgrades

More thorough planning and less excitement

Yet internally, the rewards are:

Peace of mind

Greater flexibility

Confidence amid uncertainty

Stability is a quiet strength.

You don’t need massive changes to enhance your financial outlook.

Begin with:

One thoughtful spending decision

One automated savings step

One choice to reduce debt

Over time, these small, repeated actions will transform your financial journey.

Over the years, daily decisions will determine:

Whether you perceive emergencies as manageable or overwhelming

Whether retirement seems secure or uncertain

Whether money generates anxiety or freedom

Ultimately, significant financial success is simply the disciplined practice of small habits over time.

True financial stability doesn’t spring from sudden windfalls or flawless plans; it is created through small, repeated decisions that bolster cash flow, alleviate anxiety, and build confidence over time. What you act upon today quietly dictates your position tomorrow.

Money is more influenced by habits than intentions.

This article serves purely for informational and educational purposes and should not be interpreted as financial, legal, or fiscal advice. Financial outcomes can differ based on unique incomes, expenditures, objectives, and circumstances. Consultation with a certified financial advisor is recommended before making any significant financial decisions.

Thailand Defence Minister Joins Talks to End Deadly Border Clash

Thailand’s defence chief will join talks with Cambodia as border clashes stretch into a third week,

India Raises Alarm Over Fresh Attacks on Hindus in Bangladesh

India has condemned recent killings of Hindu men in Bangladesh, calling repeated attacks on minoriti

Sidharth Malhotra & Kiara Advani Celebrate Baby Saraayah’s 1st Christmas

Sidharth and Kiara share adorable moments of baby Saraayah’s first Christmas with festive décor and

South Korea Seeks 10-Year Jail Term for Former President Yoon Suk Yeol

South Korea’s special prosecutor demands 10 years for ex-President Yoon Suk Yeol on charges includin

Salman Khan’s Exclusive 60th Birthday Bash at Panvel Farmhouse

Salman Khan to celebrate his 60th birthday privately at Panvel farmhouse with family, friends, and a

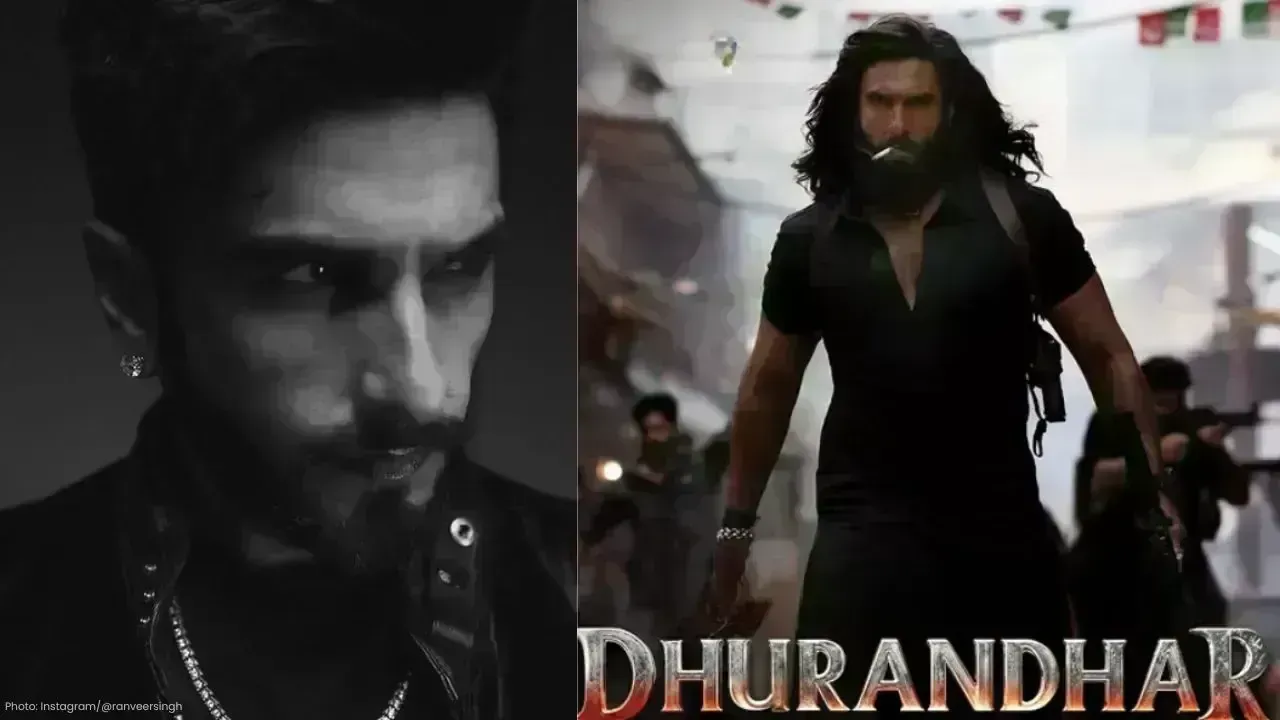

Dhurandhar Breaks Records with Rs 1006 Cr, Becomes Bollywood’s Biggest Hit

Dhurandhar rakes in over Rs 1006 crore worldwide in 21 days, becoming Bollywood’s highest-grossing f