You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Your credit score holds immense power in your financial decisions, influencing your loan approvals, interest rates, credit limits, and even potential job opportunities. Yet, many individuals find their scores fluctuating inexplicably.

These changes are far from random; they result from specific financial habits and the updates provided to credit bureaus. A clear understanding of these factors can empower you to safeguard your score effectively, rectify errors promptly, and cultivate long-term financial integrity.

This detailed guide covers both the major and nuanced factors that drive credit score changes, their interplay, and strategies for effective management.

A credit score functions as a numerical indicator of your creditworthiness, derived from your credit report data. Lenders leverage this score to gauge your likelihood of repaying borrowed funds.

Credit bureaus gather information from various financial entities, processing it through scoring models that emphasize different behavioral patterns.

Even minor transactions can lead to score changes, illustrating that credit scoring is dynamic, influenced by behavior, rather than static.

Payment history stands as the most pivotal element impacting credit score fluctuations.

Timely EMI payments

Credit card payments

Delayed payments

Missed payments

Settlements and defaults

Delinquent accounts

Even a single late payment can have a negative impact, particularly if your credit history is brief.

Late payments signify increased risk. Lenders may view someone who misses payments as potentially struggling to repay future debts.

1–30 days late leads to moderate repercussions

30–90 days late results in severe detriment

Repeated late payments can lead to long-term damage

Conversely, timely payments build trust gradually.

Your credit utilization ratio reflects your usage of available credit.

Credit used ÷ total credit limit = utilization percentage

For instance, using 40,000 from a 100,000 limit translates to 40% utilization.

High utilization indicates a reliance on credit, which may imply financial distress, regardless of timely payments.

Usage below 30% is considered healthy

Usage below 10% is excellent

Maxing out credit lines, even temporarily, can significantly lower your score.

A diverse range of credit types can enhance credit scores.

Secured loans (e.g., home or car loans)

Unsecured loans (e.g., personal loans)

Revolving credit (e.g., credit cards)

A balanced mix showcases your competence in managing numerous borrowing methods.

Refrain from taking unnecessary loans merely for mix improvement; forced borrowing may backfire if mishandled.

The duration of your credit history is instrumental in maintaining score stability.

Your oldest credit account

The average age of all accounts

Consistency in credit usage over time

Longer histories provide abundant data, resulting in heightened lender confidence.

Closing your oldest credit line diminishes the average account age and available credit, potentially lowering your score.

Each time you seek credit, lenders initiate a hard inquiry.

Every inquiry induces a minor, temporary decline

Numerous inquiries in a short span amplify this effect

Signals aggressive credit-seeking behavior

Stagger loan and card applications

Steer clear of simultaneous applications for various products

Conduct eligibility checks prior to formal applications

Regular EMI repayments

Prepayment versus erratic payment behavior

Loan restructuring or rescheduling

While prepaying is generally favorable, frequent restructuring may raise concerns.

These actions are marked as serious negatives.

A settlement indicates that you didn’t repay the complete agreed amount. Consequently, the account continues to carry a negative mark.

Significant score decline

Rebuilding trust takes years

Limits access to affordable credit

Avoid settlements unless necessary.

Adjustments in credit limits can affect your utilization ratio.

Lower utilization ratio

Potentially enhances score if expenditures remain steady

Instant increase in utilization

May trigger a score decrease

Requesting limit increases should be done judiciously to support score growth.

Occasionally, credit score variations arise from reporting mistakes.

Inaccurate late payment reports

Duplicate accounts

Inactive accounts shown as active

Incorrect personal details

Such errors can harm scores if not promptly rectified.

Regularly reviewing your credit report can help identify issues before they escalate.

Interestingly, lack of credit use can lead to stagnation or declines in your score.

Credit scores rely on active data; prolonged inactivity weakens scoring confidence.

Engage in minimal monthly transactions

Ensure timely, full payments

Maintaining active yet controlled credit behavior

This approach aids in sustaining a robust profile.

Occasionally, credit score fluctuations are shaped by external influences.

Alterations in scoring models

Updated reporting criteria

Shifts in banking policies

Though infrequent, these changes can affect many individuals at once.

Credit scores can adjust monthly based on new data.

Late payments induce immediate drops

Positive behaviors enhance scores gradually

Recovering takes more time than declining

Consistency proves more effective than quick fixes.

Reviewing your own score is a soft inquiry and doesn’t impact your credit.

Closing accounts may reduce available credit and negatively affect utilization.

Income does not directly sway credit scores; behavior is the key factor.

Automate payments wherever feasible.

Maintain spending at below 30% of your overall limit.

Apply judiciously only when necessary.

Keep your oldest credit lines active.

Regularly monitor your credit report for anomalies.

A single error won't ruin your score permanently. Credit scoring focuses on patterns over time, rather than isolated incidents.

Demonstrating responsible behavior, patience, and consistency holds more weight than transient fluctuations.

Credit score changes are neither cryptic nor uncontrollable; they arise from recognizable behaviors, fiscal discipline, and accurate data. By comprehending what sways your score, you transition from merely reacting to changes to commanding them.

Building a robust credit score is a gradual process—achieved through thoughtful everyday decisions made consistently.

This article serves solely for informational and educational purposes and should not be interpreted as financial, legal, or credit advice. Credit scoring models, weightings, and reporting conventions can vary by country, lender, and credit bureau. Readers are encouraged to seek professional financial advice before making credit decisions.

Thailand Defence Minister Joins Talks to End Deadly Border Clash

Thailand’s defence chief will join talks with Cambodia as border clashes stretch into a third week,

India Raises Alarm Over Fresh Attacks on Hindus in Bangladesh

India has condemned recent killings of Hindu men in Bangladesh, calling repeated attacks on minoriti

Sidharth Malhotra & Kiara Advani Celebrate Baby Saraayah’s 1st Christmas

Sidharth and Kiara share adorable moments of baby Saraayah’s first Christmas with festive décor and

South Korea Seeks 10-Year Jail Term for Former President Yoon Suk Yeol

South Korea’s special prosecutor demands 10 years for ex-President Yoon Suk Yeol on charges includin

Salman Khan’s Exclusive 60th Birthday Bash at Panvel Farmhouse

Salman Khan to celebrate his 60th birthday privately at Panvel farmhouse with family, friends, and a

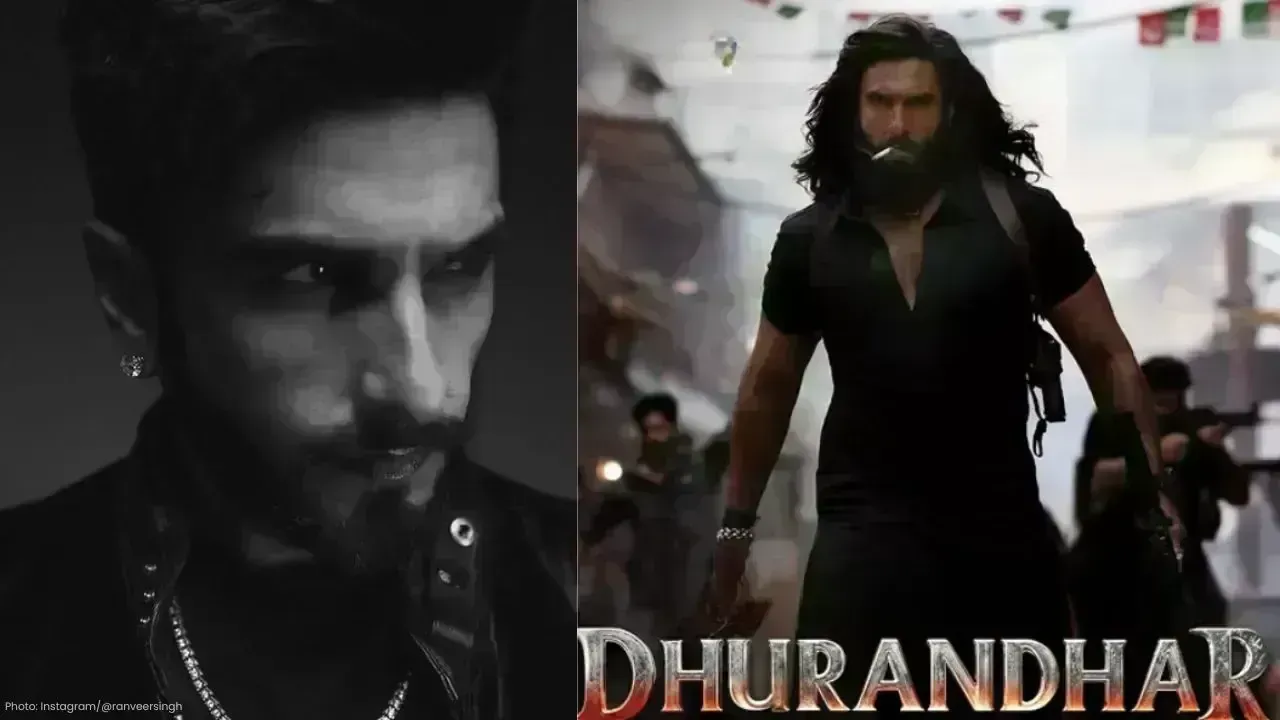

Dhurandhar Breaks Records with Rs 1006 Cr, Becomes Bollywood’s Biggest Hit

Dhurandhar rakes in over Rs 1006 crore worldwide in 21 days, becoming Bollywood’s highest-grossing f