You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Samjeet Ariff

Understanding Your Credit Score: The Complete Guide to Building, Maintaining, and Using Good Credit

Disclaimer:

This article is for informational purposes only and should not be taken as financial advice. Always consult a certified financial advisor or credit counselor for personalized recommendations.

Your credit score is more than just a number — it’s a reflection of your financial reliability. Whether you’re applying for a loan, renting an apartment, or even getting a new phone plan, your credit score can determine how much trust lenders or service providers place in you.

In this complete guide, we’ll explain what your credit score means, how it’s calculated, and the smartest ways to build and maintain strong credit for long-term financial success.

A credit score is a numerical representation of your creditworthiness — essentially, how likely you are to repay borrowed money. Most scores range from 300 to 850, with higher numbers indicating better credit health.

Why it matters:

Determines your eligibility for loans and credit cards

Affects your interest rates and credit limits

Plays a role in job applications and rental approvals

In short, a good credit score opens doors, while a poor one can make life more expensive.

Credit bureaus like Equifax, Experian, and TransUnion collect data on your financial behavior. That information is used to calculate your score based on five key factors:

| Factor | Percentage | Description |

|---|---|---|

| Payment History | 35% | Timely payments are the biggest contributor. Late payments hurt your score. |

| Credit Utilization | 30% | Using too much of your available credit lowers your score. Aim for below 30%. |

| Length of Credit History | 15% | The longer your accounts are open and active, the better. |

| New Credit Inquiries | 10% | Too many credit applications in a short period can reduce your score. |

| Credit Mix | 10% | A combination of credit types (cards, loans, mortgages) shows responsible management. |

If you’re just starting out, don’t worry — everyone begins somewhere. Here’s how to build your credit safely:

Apply for a secured credit card — backed by a deposit, perfect for beginners.

Become an authorized user on a family member’s credit card.

Use credit responsibly — make small purchases and pay them off in full each month.

Pay all bills on time, including utilities and mobile plans.

Consistency is key. Building credit takes time but pays off with better opportunities down the road.

Once you’ve built good credit, keeping it strong requires discipline. Follow these golden rules:

Pay every bill before the due date.

Keep your credit utilization low — ideally under 30% of your limit.

Review your credit report at least once a year for errors.

Limit new credit applications to avoid multiple hard inquiries.

Remember, maintaining good credit isn’t about perfection — it’s about steady, responsible habits.

A high credit score gives you access to financial advantages, but it’s important to use it wisely. You can:

Qualify for lower interest rates on loans and mortgages.

Negotiate better credit card rewards and higher limits.

Build trust with landlords or employers who check credit reports.

Refinance existing loans to save on long-term costs.

Treat credit as a tool — not free money. Responsible use today creates financial freedom tomorrow.

Even small missteps can cause your score to drop. Avoid:

Missing payments, even by a few days.

Maxing out credit cards or constantly carrying a high balance.

Closing old accounts, which shortens your credit history.

Applying for multiple cards or loans in a short period.

Each of these actions can lower your score or signal risky behavior to lenders.

You’re entitled to one free credit report each year from each major bureau. Visit official sources like AnnualCreditReport.com (for U.S. users) to monitor your credit.

To improve your score:

Pay down existing debts strategically (focus on high-interest ones first).

Set up automatic payments to avoid missed deadlines.

Dispute any inaccuracies on your report immediately.

Over time, these actions can significantly raise your credit rating.

Strong credit isn’t built overnight — it’s maintained through consistent behavior. The goal is to use credit to your advantage, not dependency.

Plan major financial moves, maintain low debt levels, and always think long-term. Good credit can mean lower costs, greater stability, and peace of mind.

Your credit score reflects your financial story — the choices, habits, and discipline behind how you manage money. By understanding how credit works and taking small, smart steps consistently, you can build a financial reputation that opens doors for life.

Thailand Defence Minister Joins Talks to End Deadly Border Clash

Thailand’s defence chief will join talks with Cambodia as border clashes stretch into a third week,

India Raises Alarm Over Fresh Attacks on Hindus in Bangladesh

India has condemned recent killings of Hindu men in Bangladesh, calling repeated attacks on minoriti

Sidharth Malhotra & Kiara Advani Celebrate Baby Saraayah’s 1st Christmas

Sidharth and Kiara share adorable moments of baby Saraayah’s first Christmas with festive décor and

South Korea Seeks 10-Year Jail Term for Former President Yoon Suk Yeol

South Korea’s special prosecutor demands 10 years for ex-President Yoon Suk Yeol on charges includin

Salman Khan’s Exclusive 60th Birthday Bash at Panvel Farmhouse

Salman Khan to celebrate his 60th birthday privately at Panvel farmhouse with family, friends, and a

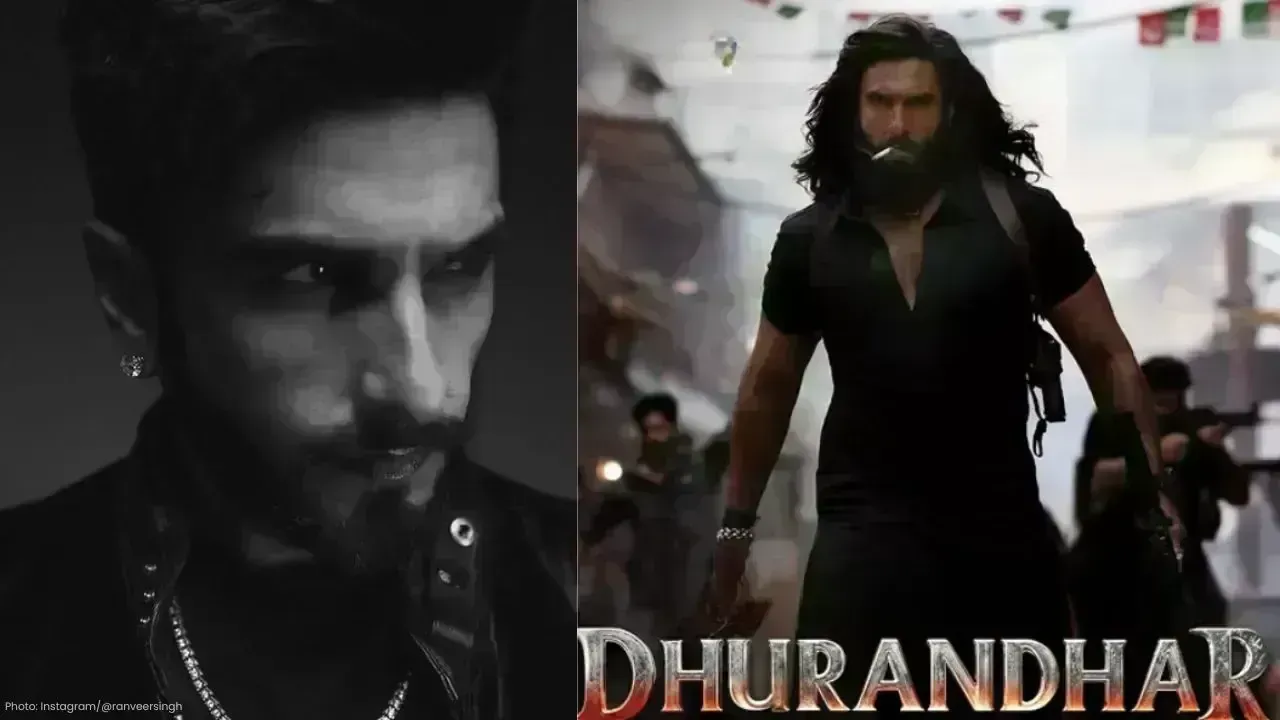

Dhurandhar Breaks Records with Rs 1006 Cr, Becomes Bollywood’s Biggest Hit

Dhurandhar rakes in over Rs 1006 crore worldwide in 21 days, becoming Bollywood’s highest-grossing f