You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Saif Rahman

On Monday, gold prices reached a remarkable milestone, exceeding $5,100 per ounce for the first time in history. This significant increase highlights investor anxiety surrounding global political issues, trade tensions, and uncertainty in the financial landscape. In times of fear, gold is often favored as a reliable asset for wealth preservation.

Spot gold gained more than 2% during the trading day, peaking at $5,110.50 per ounce before experiencing a slight adjustment. Similarly, gold futures in the United States mirrored this upward momentum. This latest surge amplifies gold's strong performance from the previous year, as it has continued to rise throughout 2026.

A pivotal factor driving this increase is the escalating worry regarding global leadership and trade policy. Unpredictable shifts in tariff threats and assertive remarks from the U.S. government have ruffled investor confidence. Concerns over potential trade disputes and political conflicts are prompting a flight to safer assets like gold, as fears grow about a slowdown in the global economy.

Additionally, central banks around the world have been steadily increasing their gold reserves, with China being a notable contributor. Concurrently, there’s been an uptick in investments in gold-backed funds, underscoring a strong long-term appetite for this precious metal.

The decline of the U.S. dollar has also played a role in elevating gold prices. A weaker dollar makes gold less expensive for investors using other currencies, thereby boosting its appeal. Market observers are keenly awaiting upcoming meetings from key central banks, which could significantly impact currency values and interest rates.

Other precious metals have also seen gains, with silver surpassing $109 per ounce to reach an all-time high. Platinum and palladium have soared to their highest levels in years. Silver's price increase is largely attributed to limited supply and robust demand from retail buyers.

Market analysts project that gold prices may rise even further this year, potentially nearing the $6,000 threshold. While brief pullbacks may occur, ongoing demand indicates that investors are prepared to seize opportunities. For the moment, gold solidifies its status as the preferred asset for those seeking stability in uncertain times.

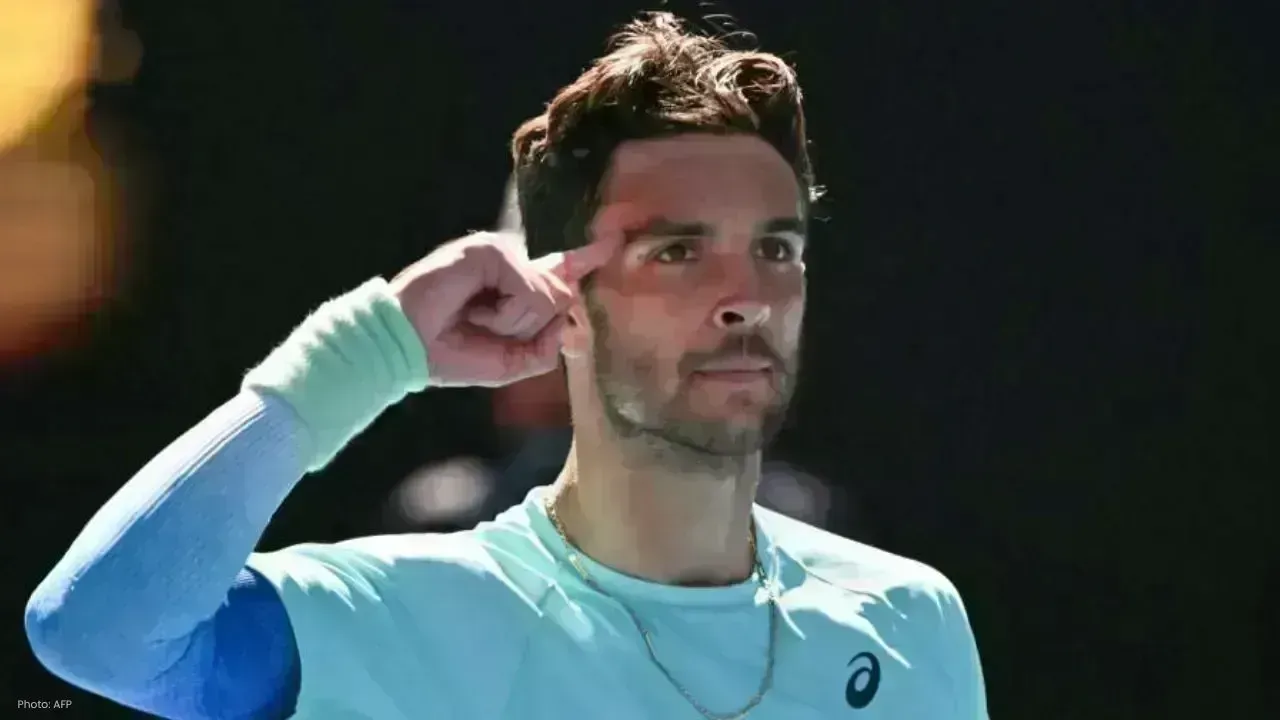

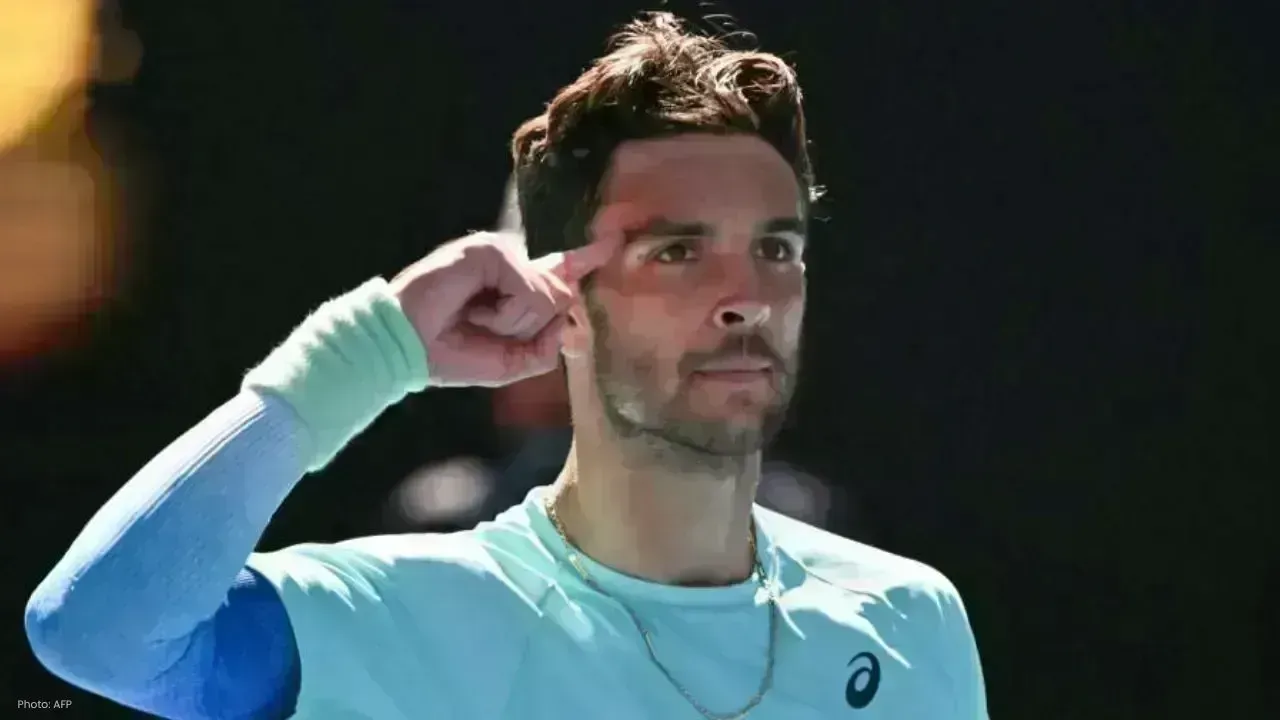

Musetti Shines, Beats Fritz to Set Up Thrilling Clash With Djokovic

Lorenzo Musetti dominates Taylor Fritz, earning a spot against Novak Djokovic in the quarterfinals w

Dubai Culture & Spotify Unite to Boost UAE Music Talent Globally

Dubai Culture partners with Spotify to empower Emirati artists, expand global reach, and nurture loc

Japan Says Farewell to Last Giant Pandas Amid Rising China Tensions

Thousands bid goodbye to Japan’s last giant pandas before their return to China, as diplomatic tensi

Doctor Tried to Save Man Shot by Immigration Agents in Minneapolis

A doctor tried to revive Alex Pretti after immigration agents shot him, but was initially stopped. T

Minneapolis Tension After U.S. Citizen Shot by Federal Immigration Agents

A U.S. citizen was fatally shot by immigration agents in Minneapolis. Officials cite self-defense, b

Devotees Flock to Khao Khitchakut for 2026 Buddha Footprint Pilgrimage

Hundreds visit Khao Khitchakut National Park to pray at the sacred Buddha footprint for blessings an