You have not yet added any article to your bookmarks!

Join 10k+ people to get notified about new posts, news and tips.

Do not worry we don't spam!

Post by : Anis Farhan

Retirement in America is no longer just about choosing a warm state and buying a quiet home. In 2026, the decision has become far more complex — shaped by inflation, rising healthcare costs, property taxes, housing shortages, and lifestyle expectations that today’s retirees refuse to compromise on.

That is why annual state-by-state retirement rankings continue to attract huge attention. These lists don’t just show where seniors might enjoy better weather or scenic beauty — they attempt to measure something much more practical: where retirement is financially sustainable and socially comfortable.

A recent 2026 ranking, based on a broad set of indicators, evaluates every U.S. state using dozens of data points across affordability, healthcare quality, and overall lifestyle factors. The results reveal some expected winners, a few surprises, and several states that struggle badly in key retiree needs like medical access and cost stability.

The retirement list is based on 46 different indicators, which means it goes far beyond the usual “sunshine and golf courses” stereotype. Instead, the methodology attempts to reflect real retiree realities, such as:

This category includes cost of living, property tax burden, state income tax, and how friendly the tax structure is for retirees relying on pensions or Social Security.

This includes access to doctors, hospital quality, long-term care availability, and how strong the healthcare infrastructure is for older residents.

This covers factors such as safety, recreation, climate, and senior-friendly community features.

Because the scoring is broad, it sometimes elevates states that may not be typical retirement “dream destinations,” but that perform strongly in practical metrics like affordability and tax burden.

The top of the list is dominated by states that offer a strong balance between low living costs and reasonable access to services, even if they are not always the most glamorous places to spend retirement.

Wyoming ranks as the best overall state to retire in 2026, largely because of its financial advantages.

Wyoming stands out as one of the most affordable and tax-friendly states for retirees. The state’s overall cost burden remains lower than many coastal states, and retirees often benefit from a more manageable taxation structure.

For seniors living on fixed incomes, Wyoming’s top placement suggests that it is one of the few states where retirement money may stretch significantly further in 2026 compared to most other parts of the country.

Wyoming’s biggest weakness is not affordability — it’s access. Rural states often struggle with healthcare availability, specialist access, and proximity to major hospitals. That said, Wyoming’s affordability score appears strong enough to offset those gaps in the overall ranking.

Florida remains one of America’s most iconic retirement states — and it continues to perform strongly in 2026.

Florida’s strengths are well-known:

A strong retirement ecosystem

Recreational opportunities

Lifestyle perks like beaches and senior communities

A tax structure that remains attractive for retirees

Florida’s ranking is powered by its quality-of-life factors and its continued reputation as a retirement hub.

The challenge for Florida is that costs are not uniform. Some areas have become dramatically more expensive in recent years. Healthcare access may also vary depending on region. Still, as a total package, Florida remains one of the most retirement-friendly states in the country.

South Dakota ranking among the top three is a reminder that retirement-friendly states aren’t always the ones that dominate travel brochures.

South Dakota’s appeal comes from its balance:

Strong affordability

Solid healthcare scoring compared to other low-population states

Stable community environment

The state’s overall infrastructure appears to support retirees without the extreme costs found in larger metropolitan states.

South Dakota is not for everyone. Retirees seeking big-city entertainment or coastal climates may not love it. But for those who value stability, space, and manageable costs, it ranks as a standout.

Colorado continues to attract people who want retirement to feel like a new chapter — not an ending.

Colorado’s ranking reflects a strong mix of:

Good healthcare

Outdoor recreation

Strong quality-of-life scores

For retirees who want to remain physically active, socially engaged, and surrounded by cultural options, Colorado offers a strong package.

Colorado’s affordability can vary significantly. Some areas, especially around major cities and mountain regions, are expensive. Still, the overall ranking suggests Colorado’s strengths outweigh its cost challenges compared to many other states.

Minnesota rounds out the top five — a result driven by healthcare and quality-of-life factors.

Minnesota’s healthcare infrastructure is widely viewed as strong, and the state consistently scores well in metrics tied to senior well-being. Retirees who prioritize medical access and long-term care options often consider these strengths non-negotiable.

Minnesota’s winters remain the main lifestyle trade-off. However, the ranking suggests that for many retirees, healthcare reliability and overall stability are worth it.

Beyond the top five, several states also make the top ten list, including:

Alaska

Delaware

Pennsylvania

New Hampshire

Iowa

Each of these states appears to score well in at least one major retirement pillar — either affordability, healthcare, or lifestyle.

The bottom of the ranking reveals a different story: states where retirees may face serious challenges due to weak healthcare infrastructure, low quality-of-life metrics, or affordability pressures.

Kentucky ranks as the worst state for retirement in 2026.

Kentucky’s performance appears dragged down by:

Weak healthcare outcomes

Limited access to quality medical services

Poor overall retiree readiness

This is significant because healthcare becomes one of the most important retirement needs as people age. Even a low cost of living cannot fully compensate for inadequate medical access.

Several other states also land near the bottom, including:

Oklahoma struggles with healthcare and quality-of-life measures, despite having some affordability advantages.

Mississippi remains challenged by healthcare quality and broader life-quality indicators, keeping it among the lowest-ranked states for retirees.

West Virginia scores poorly in multiple categories tied to retirement stability, including access to care.

Hawaii is a unique case. It has lifestyle appeal and natural beauty, but it is dragged down by extreme affordability issues — proving that paradise is not always retiree-friendly in financial terms.

Retirement rankings are useful, but they are not a final answer. Instead, they serve as a starting point for deeper planning.

Even a top-ranked state may be a poor choice if it is far from family, lacks cultural comfort, or has a climate a retiree cannot tolerate. Likewise, a lower-ranked state may still work well for someone who already owns a home there, has family support nearby, or has strong local healthcare access.

Across the ranking, the most consistent retirement drivers remain:

Affordability and tax structure

Healthcare quality and access

Quality-of-life stability

The states that rank highest tend to offer at least two of these strongly, while the states at the bottom often fail in more than one.

The 2026 state rankings underline a reality many Americans are already feeling: retirement is increasingly shaped by economics and access, not just preference.

States like Wyoming, Florida and South Dakota rise because they make retirement financially manageable and livable. Meanwhile, states like Kentucky, Mississippi and West Virginia remain difficult because they struggle with healthcare access and retiree readiness — challenges that become more serious with age.

Ultimately, the best retirement state is not just the one that ranks highest — it is the one that aligns with a retiree’s health needs, budget, lifestyle expectations and support system.

Disclaimer: This article is based on publicly available rankings and reporting from 2026. Rankings are influenced by methodology and may not reflect individual circumstances. Readers should conduct personal research and consult professional financial or retirement planners before making relocation decisions.

Taylor Swift Moves to Block ‘Swift Home’ Trademark in U.S. Legal Challenge

Global pop icon Taylor Swift has petitioned the U.S. Patent and Trademark Office to deny a trademark

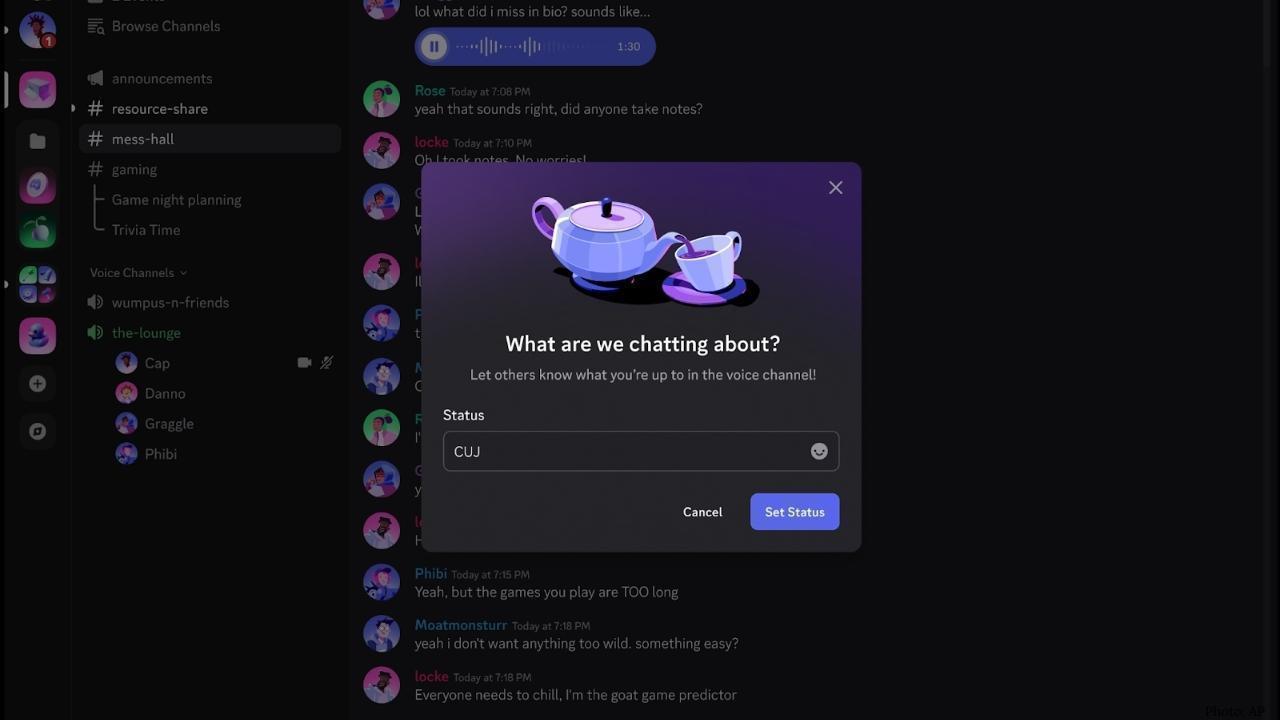

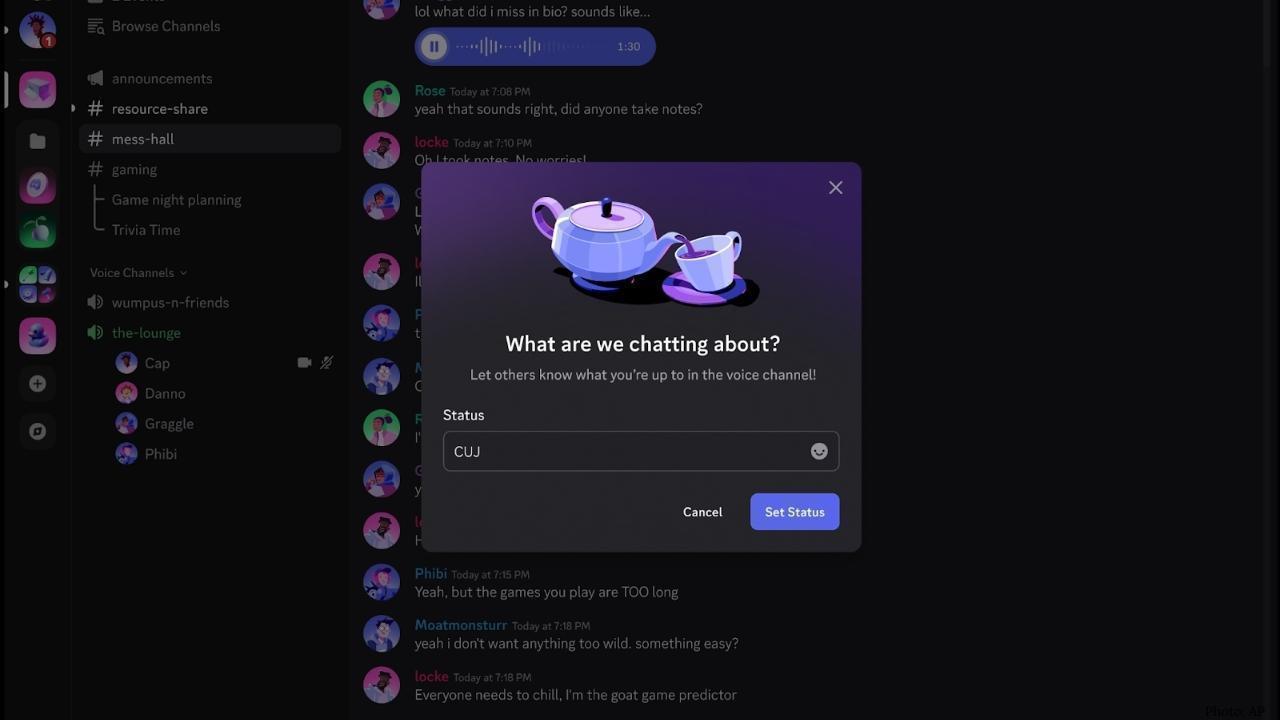

Discord’s Global Age Verification Rollout Sparks Privacy Backlash After Data Breach

Messaging platform Discord has announced a global age-verification system that will automatically ma

India’s T20 World Cup Reality Check: Middle-Overs Batting Exposed Despite Convincing Win

In a commanding India vs Namibia T20 World Cup performance, India secured a convincing victory, but

New Dhaka Era: How the BNP Seized Power in Bangladesh’s Historic Election

Bangladesh’s 2026 parliamentary elections yielded a dramatic political shift as the Bangladesh Natio

Trump Plans First Meeting of New Peace Board in Washington This February

Former U.S. President Donald Trump is reportedly preparing to convene the inaugural session of a new

Apple’s iOS 26.3 Update Is Here — Why Millions of iPhone Users Should Install It Now

Apple has rolled out iOS 26.3 as a critical update for eligible iPhones, bringing important security